Multiple Choice

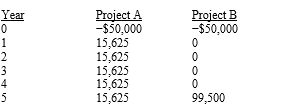

Two projects being considered are mutually exclusive and have the following projected cash flows:  If the required rate of return on these projects is 10 percent,which would be chosen and why?

If the required rate of return on these projects is 10 percent,which would be chosen and why?

A) Project B because of higher NPV.

B) Project B because of higher IRR.

C) Project A because of higher NPV.

D) Project A because of higher IRR.

E) Neither,because both have IRRs less than the required return.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Which of the following statements is correct?<br>A)

Q38: Two fellow financial analysts are evaluating a

Q39: Which of the following statements is false?<br>A)

Q40: Estimating the cash flows in a capital

Q43: One of the advantages of the payback

Q44: Many firms use more than one technique

Q45: In theory,the decision maker should view market

Q46: When a project's NPV exceeds zero,<br>A) The

Q48: Risk in a revenue-producing project can best

Q62: California Mining is evaluating the introduction of