Multiple Choice

Table 12-14

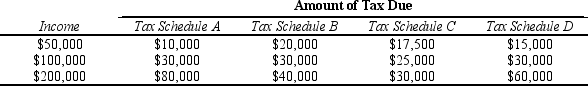

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-14.Which tax schedule could be considered a lump-sum tax?

A) Tax Schedule B only

B) Tax Schedule B and Tax Schedule C

C) Tax Schedule D only

D) None of the tax schedules could be considered a lump-sum tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Table 12-8<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2185/.jpg" alt="Table 12-8

Q38: Part of the administrative burden of a

Q39: The single largest expenditure by state and

Q48: Vertical equity refers to a tax system

Q101: In addition to tax payments, the two

Q106: A recent increase in federal gasoline taxes

Q122: In the absence of taxes,Janet would prefer

Q124: Marcus faces a progressive federal income tax

Q129: Stacy places a $20 value on a

Q130: Which of the following is not an