Multiple Choice

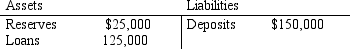

Table 29-4.

The First Bank of Wahooton

-Refer to Table 29-4.If the bank faces a reserve requirement of 10 percent,then the bank

A) is in a position to make a new loan of $15,000.

B) has fewer reserves than are required.

C) has excess reserves of $10,000.

D) None of the above is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Economists use the word "money" to refer

Q9: Scenario 29-1.<br>The monetary policy of Salidiva is

Q10: An increase in reserve requirements increases reserves

Q13: Which of the following is not correct?<br>A)

Q16: The double coincidence of wants<br>A) is required

Q37: The money supply increases when the Fed<br>A)buys

Q77: Which of the following is a function

Q87: In December 1999 people feared that there

Q89: The Federal Deposit Insurance Corporation<br>A)protects depositors in

Q98: In an economy that relies on barter,