Multiple Choice

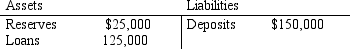

Table 29-4.

The First Bank of Wahooton

-Refer to Table 29-4.Suppose the bank faces a reserve requirement of 10 percent.Starting from the situation as depicted by the T-account,a customer deposits an additional $50,000 into his account at the bank.If the bank takes no other action it will

A) have $65,000 in excess reserves.

B) have $55,000 in excess reserves.

C) need to raise an additional $5,000 of reserves to meet the reserve requirement

D) None of the above is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: In 1991,the Federal Reserve lowered the reserve

Q4: Given the following information,what are the values

Q5: If $300 of new reserves generates $800

Q8: Economists use the word "money" to refer

Q9: Scenario 29-1.<br>The monetary policy of Salidiva is

Q10: An increase in reserve requirements increases reserves

Q77: Which of the following is a function

Q79: Which of the following is included in

Q89: The Federal Deposit Insurance Corporation<br>A)protects depositors in

Q404: Suppose the Fed requires banks to hold