Multiple Choice

In audits of companies in which payroll is a significant portion of inventory,the improper account classification of payroll can:

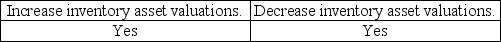

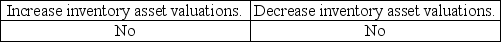

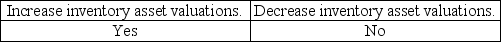

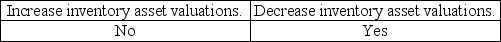

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: What are the two major balance-related audit

Q14: How do auditors commonly verify sales commission

Q22: The most important means of verifying account

Q30: Which of the following is a substantive

Q36: As a part of the auditor's responsibility

Q48: Which of the following types of audit

Q57: There is inherent risk of payroll fraud

Q64: The job time ticket indicates the starting

Q107: A weak internal control system allows a

Q121: The computer file used for recording payroll