Multiple Choice

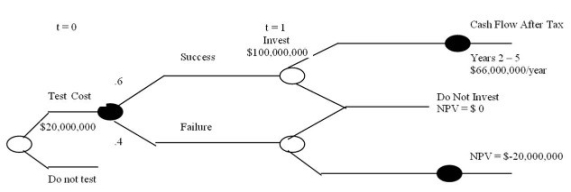

The project defined by the following decision tree has a required discount rate of 14 percent.

What is the Time 1 net present value of a successful investment?

A) $89,406,415

B) $92,305,012

C) $87,342,087

D) $122,008,054

E) $126,583,344

Correct Answer:

Verified

Correct Answer:

Verified

Q47: All else constant,as the variable cost per

Q48: Which one of the following statements is

Q61: Which type of analysis is most dependent

Q61: The financial breakeven point determines which one

Q62: Isabelle is reviewing a project with projected

Q63: ELK,Inc.has compiled this information for a proposed

Q64: Sensitivity analysis helps determine the<br>A)range of possible

Q67: Monte Carlo simulation is based on assigning

Q69: A proposed project has fixed costs of

Q70: Sensitivity analysis of a project is conducted