Multiple Choice

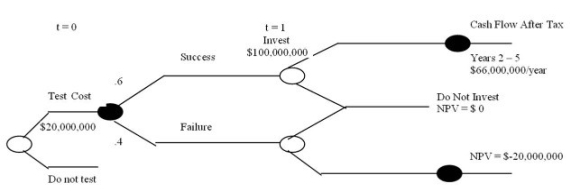

The project defined by the following decision tree has a required discount rate of 17 percent.

What is the Time 0 net present value of a successful test and investment?

A) $21,565,903

B) $26,997,143

C) $32,288,788

D) $16,997,143

E) $42,997,143

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Ignoring taxes,which one of these is a

Q6: The point where a project produces a

Q12: In scenario analysis,which one of the following

Q23: Which one of these is a disadvantage

Q23: In financial breakeven,the EAC is used to<br>A)allocate

Q24: Mosler Company is considering a project requiring

Q26: The investment timing decision relates to<br>A)how long

Q28: At a production level of 7,500 units,a

Q29: Rizzo's is considering a project with a

Q30: Kurt's Coffees has a new hot drink