Multiple Choice

Figure 15-12

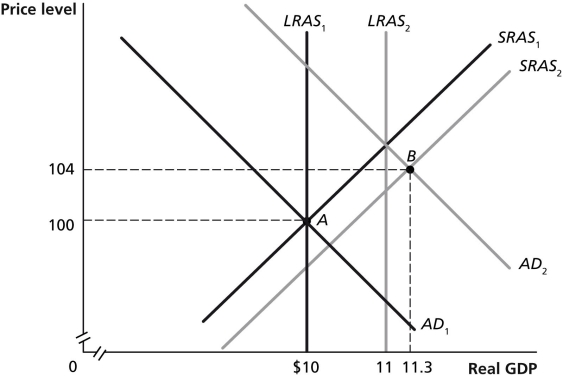

-Refer to Figure 15-12.In the dynamic AD-AS model,if the economy is at point A in year 1 and is expected to go to point B in year 2,the Federal Reserve would most likely

A) increase interest rates.

B) decrease interest rates.

C) not change interest rates.

D) increase the inflation rate.

Correct Answer:

Verified

Correct Answer:

Verified

Q178: Your roommate is having trouble grasping how

Q179: Table 15-6<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1236/.jpg" alt="Table 15-6

Q180: The smaller the fraction of an investment

Q181: In October 2008,Congress passed the _,under which

Q182: Inflation rates during the years 1979-1981 were

Q184: Write out the expression for the Taylor

Q185: The interest rate the Fed pays banks

Q186: Table 15-7<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1236/.jpg" alt="Table 15-7

Q187: Buying a house during a recession may

Q188: Expansionary monetary policy to prevent real GDP