Multiple Choice

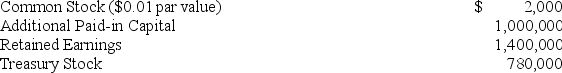

At the end of the prior year,Atoka Industries reported the following account balances:  The treasury stock arose from a purchase of 10,000 shares of common stock for $78 per share.If the 10,000 treasury shares are issued for $50 per share in the current year,what journal entry must be prepared to record the transaction?

The treasury stock arose from a purchase of 10,000 shares of common stock for $78 per share.If the 10,000 treasury shares are issued for $50 per share in the current year,what journal entry must be prepared to record the transaction?

A) Debit Cash for $500,000,debit Other Losses for $280,000,and credit Treasury Stock for 780,000.

B) Debit Cash for $500,000,credit Common Stock for $100,and credit Additional Paid-in Capital for $499,900.

C) Debit Cash for $500,000,debit Additional Paid-in Capital for $280,000,and credit Treasury Stock for $780,000.

D) Debit Cash and credit Treasury Stock for $500,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: How do stock splits and stock dividends

Q2: A corporation had 10,000 shares of $10

Q3: Barbur,Inc.reported net income of $12 million.During the

Q5: Preferred stock is generally classified as stockholders'

Q6: Match each term with the appropriate definition.Not

Q7: Match each term with the appropriate definition.Not

Q8: The journal entry to record a large

Q9: Barbur,Inc.reported net income of $12 million.During the

Q10: If Crystal Spring Company's P/E ratio is

Q11: The rights of current stockholders to purchase