Multiple Choice

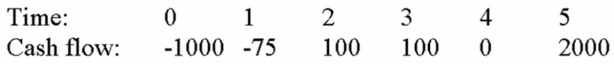

Compute the IRR for Project X and note whether the firm should accept or reject the project with the cash flows shown below if the appropriate cost of capital is 9 percent.

A) 9%, accept

B) 9%, reject

C) 16.61%, accept

D) 16.61%, reject

Correct Answer:

Verified

Correct Answer:

Verified

Q33: A capital budgeting method that converts a

Q72: All of the following capital budgeting tools

Q73: Neither payback period nor discounted payback period

Q73: Use the payback decision rule to evaluate

Q75: Which rate-based decision statistic measures the excess

Q79: Use the discounted payback decision rule to

Q80: All of the following capital budgeting tools

Q81: Suppose your firm is considering investing in

Q82: Use the MIRR decision rule to evaluate

Q84: A capital budgeting technique that generates a