Multiple Choice

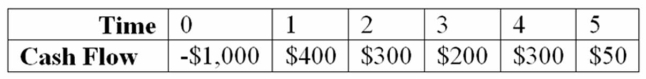

Compute the MIRR statistic for Project I and note whether to accept or reject the project with the cash flows shown below if the appropriate cost of capital is 15 percent. Project I

A) The project's MIRR is 10.29% and the project should be rejected.

B) The project's MIRR is 12.67% and the project should be rejected.

C) The project's MIRR is 17.17% and the project should be accepted.

D) The project's MIRR is 18.19% and the project should be accepteD.Cash flows will be moved as shown below:

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Which of the following is incorrect regarding

Q33: Use the IRR decision rule to evaluate

Q60: Use the NPV decision rule to evaluate

Q62: These are groups or pairs of projects

Q64: Compute the Payback statistic for Project X

Q65: All of the following capital budgeting tools

Q67: Use the PI decision rule to evaluate

Q68: Suppose your firm is considering investing in

Q79: Use the discounted payback decision rule to

Q109: Which of the following statements is correct?<br>A)Discounted