Multiple Choice

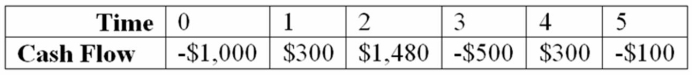

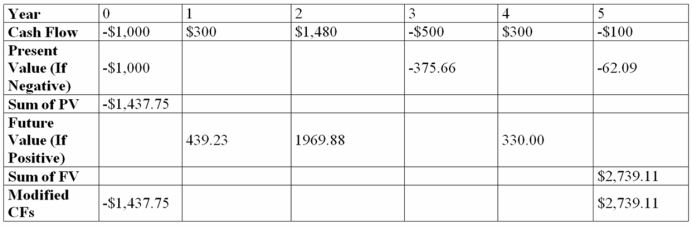

Compute the MIRR statistic for Project J and advise whether to accept or reject the project with the cash flows shown below if the appropriate cost of capital is 10 percent. Project J

A) The project's MIRR is 14.77% and the project should be accepted.

B) The project's MIRR is 9.29% and the project should be rejected.

C) The project's MIRR is 13.76% and the project should be accepted.

D) The project's MIRR is 15.31% and the project should be accepteD.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The benchmark for the Profitability Index, PI,

Q8: Suppose your firm is considering investing in

Q12: Suppose your firm is considering investing in

Q14: We accept projects with a positive NPV

Q83: Suppose two projects with normal cash flows,X

Q94: Use the NPV decision rule to evaluate

Q100: Use the payback decision rule to evaluate

Q100: Use the payback decision rule to evaluate

Q102: A project's IRR:<br>A)is the average rate of

Q106: Projects A and B are mutually exclusive.