Multiple Choice

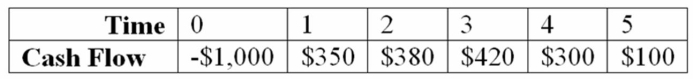

Compute the PI statistic for Project Z and advise the firm whether to accept or reject the project with the cash flows shown below if the appropriate cost of capital is 10 percent. Project Z

A) The project's PI is 8.48% and the project should be accepted.

B) The project's PI is 8.48% and the project should be rejected.

C) The project's PI is 16.48% and the project should be accepted.

D) The project's PI is 21.48% and the project should be accepteD.Step 1: Find NPV using financial calculator: NPV = 214.78; Step 2: 214.78/1000 = 21.48% and since PI>0 accept.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Suppose your firm is considering investing in

Q14: We accept projects with a positive NPV

Q18: Use the MIRR decision rule to evaluate

Q20: A capital budgeting technique that generates a

Q21: Suppose your firm is considering investing in

Q22: Compute the MIRR statistic for Project X

Q37: All capital budgeting techniques<br>A) render the same

Q94: Use the NPV decision rule to evaluate

Q102: A project's IRR:<br>A)is the average rate of

Q106: Projects A and B are mutually exclusive.