Multiple Choice

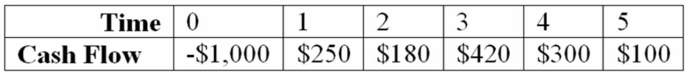

Compute the PI statistic for Project Q and advise the firm whether to accept or reject the project with the cash flows shown below if the appropriate cost of capital is 12 percent. Project Q

A) The project's PI is -8.70% and the project should be rejected.

B) The project's PI is -11.70% and the project should be rejected.

C) The project's PI is 3.70% and the project should be accepted.

D) The project's PI is 5.70% and the project should be accepteD.Step 1: Find NPV using financial calculator: NPV = -86.95; Step 2: -86.95/1000 = -8.70% and since PI<0 reject.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: When choosing between two mutually exclusive projects

Q79: Use the discounted payback decision rule to

Q86: A capital budgeting technique that generates decision

Q88: Compute the NPV statistic for Project U

Q91: A disadvantage of the payback statistic is

Q92: All of the following are strengths of

Q93: The MIRR statistic is different from the

Q94: Use the NPV decision rule to evaluate

Q94: Use the NPV decision rule to evaluate

Q95: Compute the Payback statistic for Project Y