Essay

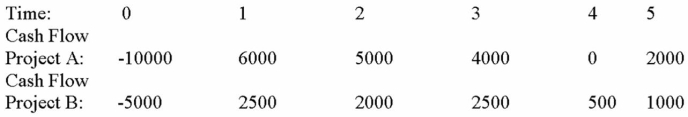

Calculate the rate at which the follow projects' NPV profiles cross and explain when IRR will give the correct answer when choosing between these two mutually exclusive projects.

Correct Answer:

Verified

Next, calculate IRR for this new set of...

Next, calculate IRR for this new set of...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q21: Suppose your firm is considering investing in

Q22: Compute the MIRR statistic for Project X

Q23: Which of the following tools is suitable

Q24: All of the following capital budgeting tools

Q27: Use the discounted payback decision rule to

Q28: Compute the NPV for Project X and

Q30: Is the set of cash flows depicted

Q31: This technique for evaluating capital projects tells

Q33: Use the IRR decision rule to evaluate

Q100: Rank the capital budgeting tools from best