Multiple Choice

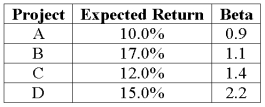

An all-equity firm is considering the projects shown below. The T-bill rate is 3 percent and the market risk premium is 6 percent. If the firm uses its current WACC of 12 percent to evaluate these projects, which project(s) will be incorrectly rejected?

A) Project A

B) Projects B and C

C) Project D

D) Project B

Correct Answer:

Verified

Correct Answer:

Verified

Q8: When calculating WACC,should project-specific or firmwide debt

Q49: The _ approach to computing a divisional

Q107: Suppose that Wave Runners' common shares sell

Q108: A firm uses only debt and equity

Q110: Sea Shell Industries has 50 million shares

Q113: Suppose that Glamour Nails, Inc.'s capital structure

Q114: JAK Industries has 5 million shares of

Q115: Oberon Inc. has a $20 million ($1000

Q116: Apple's 9% annual coupon bond has 10

Q117: ADK Industries common shares sell for $40