Multiple Choice

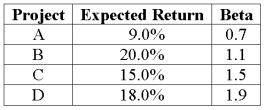

An all-equity firm is considering the projects shown below. The T-bill rate is 4 percent and the market risk premium is 8 percent. If the firm uses its current WACC of 13 percent to evaluate these projects, which project(s) will be incorrectly accepted?

A) Project A

B) Project C

C) Project D

D) Projects C and D

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following is a situation

Q21: This is an estimated WACC computed using

Q23: Cup Cake Ltd. has 20 million shares

Q25: Suppose that TipsNToes, Inc.'s capital structure features

Q27: Suppose your firm has decided to use

Q30: Accessory Industries has 2 million shares of

Q31: ADK has 30,000 15-year 9% annual coupon

Q99: Flotation costs are:<br>A)insignificant and can be assumed

Q109: List and explain all the components of

Q112: When calculating the weighted average cost of