Multiple Choice

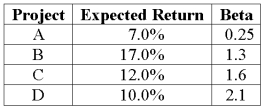

An all-equity firm is considering the projects shown below. The T-bill rate is 4 percent and the market risk premium is 9 percent. If the firm uses its current WACC of 14 percent to evaluate these projects, which project(s) will be incorrectly rejected?

A) Project A

B) Project B

C) Project C

D) Project D

Correct Answer:

Verified

Correct Answer:

Verified

Q4: PAW Industries has 5 million shares of

Q5: XYZ Industries has 10 million shares of

Q6: Diddy Corp stock has a beta of

Q7: Why do we use market-value weights instead

Q9: Johnny Cake Ltd. has 10 million shares

Q10: Rose has preferred stock selling for 99

Q11: Fern has preferred stock selling for 95

Q29: Which of the following will directly impact

Q81: Which of the following makes this a

Q89: A proxy beta is:<br>A)the average beta of