Multiple Choice

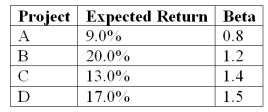

An all-equity firm is considering the projects shown below. The T-bill rate is 3% and the market risk premium is 6%. If the firm uses its current WACC of 12% to evaluate these projects, which project(s) , if any, will be incorrectly rejected?

A) Only Project A would be incorrectly rejected.

B) Both Projects A and C would be incorrectly rejected.

C) Projects A, B and C would be incorrectly rejected.

D) None of the projects would be incorrectly rejecteD.Step 1: Find Project Required Returns using CAPM. Project A: 7.8%; Project B: 10.2%; Project C: 11.4%; Project D: 12%; only Project A would be incorrectly rejected since its required return is only 7.8% given its risk and it is expected to return 9%.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Which of these makes this a true

Q8: What is the theoretical minimum for the

Q76: Suppose that Tan Lotion's common shares sell

Q77: FDR Industries has 50 million shares of

Q78: Rings N Things Industries has 40 million

Q79: Suppose your firm has decided to use

Q82: JLP Industries has 6.5 million shares of

Q83: IVY has preferred stock selling for 98

Q84: FlavR Co stock has a beta of

Q87: Which statement makes this a false statement?