Multiple Choice

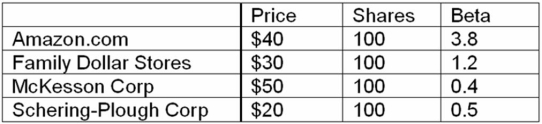

You hold the positions in the table below. What is the beta of your portfolio? If you expect the market to earn 12 percent and the risk-free rate is 3.5 percent, what is the required return of the portfolio?

A) 14.21%

B) 16.76%

C) 13.97%

D) 15.38%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q30: You own $9,000 of Olympic Steel stock

Q40: Expected Return Compute the expected return given

Q41: Risk Premiums You own $14,000 of Diner's

Q42: Stock Market Bubble If the NASDAQ stock

Q43: Required Return Using the information in the

Q44: You have a portfolio consisting of 20%

Q47: The study of the cognitive processes and

Q48: Similar to the Capital Market Line except

Q49: In theory, this is a combination of

Q60: How might a large market risk premium