Multiple Choice

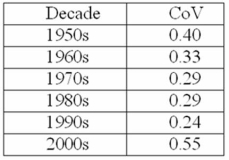

Consider the risk-return relationship in T-bills during each decade since 1950. Given this data, which of the following statements is correct?

A) The best risk-return relationship was during the 1950s.

B) The best risk-return relationship was during the 1990s.

C) Since T-bills are backed by the full faith of the U.S. government, computing the risk-return relationship for them is invalid.

D) None of these statements are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Rank the following three stocks by their

Q5: Consider the characteristics of the following three

Q6: Standard Deviation Compute the standard deviation of

Q7: Which of the following statements is correct?<br>A)

Q21: The efficient frontier portfolios are<br>A) portfolios that

Q63: What does diversification do to the risk

Q76: Which of the following is correct regarding

Q78: Total Risk Rank the following three stocks

Q79: Describe the diversification potential of two assets

Q95: You are a risk-averse investor with a