Multiple Choice

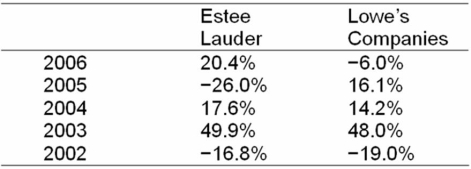

Consider the following annual returns of Estee Lauder and Lowe's Companies:  Compute each stock's average return, standard deviation, and coefficient of variation.

Compute each stock's average return, standard deviation, and coefficient of variation.

A) Estee Lauder: 9.02%; 17.99%; 2.00 Lowe's Companies: 10.66%; 18.99%; 1.78

B) Estee Lauder: 9.02%; 30.69%; 3.4 Lowe's Companies: 10.66%; 18.99%; 1.78

C) Estee Lauder: 9.02%; 30.69%; 3.4 Lowe's Companies: 10.66%; 25.46%; 2.39

D) Estee Lauder: 10.7%; 17.79%; 1.66 Lowe's Companies: 12.64%; 18.99%; 1.50

Correct Answer:

Verified

Correct Answer:

Verified

Q38: An investor owns $8,000 of Adobe Systems

Q48: Which of the following statements is correct

Q65: Portfolio Weights If you own 1000 shares

Q66: If you own 300 shares of Alaska

Q68: Risk, Return, and Their Relationship Consider the

Q71: A stock has an expected return of

Q73: Risk, Return, and Their Relationship Consider the

Q75: From 1950 to 2007, the average return

Q80: Rank the following three stocks by their

Q88: Which of these statements is true?<br>A) When