Multiple Choice

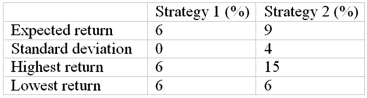

Consider these two investment strategies:  Strategy __________ is the dominant strategy because __________.

Strategy __________ is the dominant strategy because __________.

A) 1; it is riskless

B) 1; it has the highest reward/risk ratio

C) 2; its return is at least equal to Strategy 1 and sometimes greater

D) 2; it has the highest reward/risk ratio

E) Both strategies are equally preferred.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: A manager who uses the mean-variance theory

Q11: If a portfolio manager consistently obtains a

Q27: Consider these two investment strategies: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2464/.jpg"

Q28: Tracking error is defined as<br>A) the difference

Q29: Active portfolio management consists of<br>A)market timing.<br>B)security analysis.<br>C)indexing.<br>D)market

Q31: Discuss the Treynor-Black model.

Q34: To improve future analyst forecasts using the

Q35: There appears to be a role for

Q36: Kane, Marcus, and Trippi (1999) show that

Q37: Absent research, you should assume the alpha