Multiple Choice

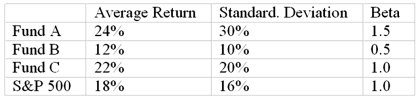

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation.The risk-free return during the sample period is 6%.The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.  The fund with the highest Sharpe measure is

The fund with the highest Sharpe measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest) .

E) Funds A and C (tied for highest) .

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Suppose the risk-free return is 4%. The

Q32: The geometric average rate of return is

Q54: Suppose two portfolios have the same average

Q55: Define and discuss the Sharpe, Treynor, and

Q57: The dollar-weighted return on a portfolio is

Q58: The M-squared measure considers<br>A)only the return when

Q60: Discuss, in general, the performance attribution procedures.

Q61: You want to evaluate three mutual funds

Q62: The comparison universe is<br>A)a concept found only

Q64: You invested $1,000 through your broker three