Multiple Choice

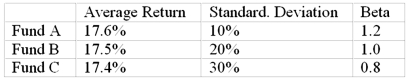

You want to evaluate three mutual funds using the Jensen measure for performance evaluation.The risk-free return during the sample period is 6%, and the average return on the market portfolio is 18%.The average returns, standard deviations, and betas for the three funds are given below.  The fund with the highest Jensen measure is

The fund with the highest Jensen measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest) .

E) Funds A and C (tied for highest) .

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Suppose two portfolios have the same average

Q18: The following data are available relating to

Q19: Suppose two portfolios have the same average

Q20: Suppose a particular investment earns an arithmetic

Q22: The _ measures the reward to volatility

Q24: The following data are available relating to

Q26: Suppose two portfolios have the same average

Q35: Suppose you purchase one share of the

Q53: The Value Line Index is an equally-weighted

Q66: Henriksson (1984) found that, on average, betas