Multiple Choice

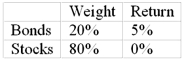

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:  The return on a bogey portfolio was 2%, calculated from the following information.

The return on a bogey portfolio was 2%, calculated from the following information.  The total excess return on the Razorback Fund's managed portfolio was

The total excess return on the Razorback Fund's managed portfolio was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The Modigliani M<sup>2</sup> measure and the Treynor

Q29: Suppose the risk-free return is 3%. The

Q34: The following data are available relating to

Q37: Suppose two portfolios have the same average

Q38: Suppose two portfolios have the same average

Q39: In measuring the comparative performance of different

Q43: The comparison universe is not<br>A) a concept

Q44: _ developed a popular method for risk-adjusted

Q56: Hedge funds I) are appropriate as a

Q70: Rodney holds a portfolio of risky assets