Multiple Choice

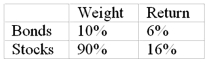

In a particular year, Aggie Mutual Fund earned a return of 15% by making the following investments in the following asset classes:  The return on a bogey portfolio was 10%, calculated as follows:

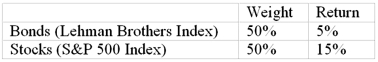

The return on a bogey portfolio was 10%, calculated as follows:  The total excess return on the Aggie managed portfolio was

The total excess return on the Aggie managed portfolio was

A) 1%.

B) 3%.

C) 4%.

D) 5%.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: The following data are available relating to

Q43: Risk-adjusted mutual fund performance measures have decreased

Q44: The following data are available relating to

Q44: _ developed a popular method for risk-adjusted

Q45: The following data are available relating to

Q48: The following data are available relating to

Q50: The following data are available relating to

Q65: Suppose the risk-free return is 6%. The

Q67: To determine whether portfolio performance is statistically

Q78: The M<sup>2</sup> measure was developed by<br>A) Merton