Multiple Choice

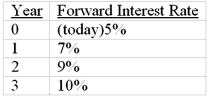

Suppose that all investors expect that interest rates for the 4 years will be as follows:  If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same (Par value of the bond = $1,000)

If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same (Par value of the bond = $1,000)

A) 5%

B) 7%

C) 9%

D) 10%

E) None of the options

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Term Structure of Interest Rates is the

Q7: If the value of a Treasury bond

Q8: When computing yield to maturity, the implicit

Q9: Explain what the following terms mean: spot

Q11: _ can occur if _.<br>A)arbitrage; the law

Q12: The most recently issued Treasury securities are

Q12: The pure yield curve can be estimated<br>A)

Q14: Suppose that all investors expect that interest

Q15: An upward sloping yield curve is a(n)

Q44: The on the run yield curve is<br>A)