Multiple Choice

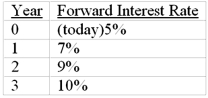

Suppose that all investors expect that interest rates for the 4 years will be as follows:  What is the yield to maturity of a 3-year zero-coupon bond

What is the yield to maturity of a 3-year zero-coupon bond

A) 7.03%

B) 9.00%

C) 6.99%

D) 7.49%

E) None of the options

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: Forward rates _ future short rates because

Q24: Treasury STRIPS are<br>A) securities issued by the

Q27: Suppose that all investors expect that interest

Q28: Suppose that all investors expect that interest

Q30: An upward sloping yield curve<br>A)may be an

Q31: Although the expectations of increases in future

Q33: The following is a list of prices

Q35: Given the yield on a 3 year

Q37: The following is a list of prices

Q50: An inverted yield curve is one<br>A) with