Multiple Choice

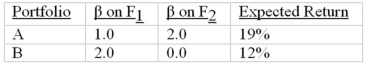

Consider the multifactor APT.There are two independent economic factors, F1 and F2.The risk-free rate of return is 6%.The following information is available about two well-diversified portfolios:  Assuming no arbitrage opportunities exist, the risk premium on the factor F1 portfolio should be

Assuming no arbitrage opportunities exist, the risk premium on the factor F1 portfolio should be

A) 3%.

B) 4%.

C) 5%.

D) 6%.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Consider the one-factor APT. The variance of

Q19: In a multifactor APT model, the coefficients

Q23: Consider the one-factor APT. The standard deviation

Q42: A well-diversified portfolio is defined as<br>A) one

Q45: Which of the following is true about

Q46: Consider a single factor APT. Portfolio A

Q51: The _ provides an unequivocal statement on

Q56: Consider the one-factor APT. The variance of

Q57: In the context of the Arbitrage Pricing

Q73: The term "arbitrage" refers to<br>A) buying low