Multiple Choice

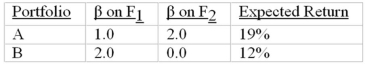

Consider the multifactor APT.There are two independent economic factors, F1 and F2.The risk-free rate of return is 6%.The following information is available about two well-diversified portfolios:  Assuming no arbitrage opportunities exist, the risk premium on the factor F2 portfolio should be

Assuming no arbitrage opportunities exist, the risk premium on the factor F2 portfolio should be

A) 3%.

B) 4%.

C) 5%.

D) 6%.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: There are three stocks: A, B, and

Q34: Which of the following factors were used

Q40: In the APT model, what is the

Q51: Discuss the advantages of arbitrage pricing theory

Q52: Security A has a beta of 1.0

Q53: In a factor model, the return on

Q56: An arbitrage opportunity exists if an investor

Q58: The following factors might affect stock returns<br>A)the

Q63: Suppose you are working with two factor

Q68: Which of the following factors did Chen,