Multiple Choice

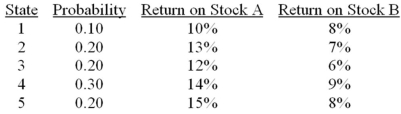

Consider the following probability distribution for stocks A and B:  The variances of stocks A and B are _____ and _____, respectively.

The variances of stocks A and B are _____ and _____, respectively.

A) 1.5%; 1.9%

B) 2.2%; 1.2%

C) 3.2%; 2.0%

D) 1.5%; 1.1%

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Consider two perfectly negatively correlated risky securities

Q6: Which one of the following portfolios cannot

Q7: Consider the following probability distribution for stocks

Q9: Consider the following probability distribution for stocks

Q10: For a two-stock portfolio, what would be

Q12: Firm-specific risk is also referred to as<br>A)systematic

Q13: Consider the following probability distribution for stocks

Q24: The standard deviation of a two-asset portfolio

Q49: Security X has expected return of 7%

Q75: The line representing all combinations of portfolio