Multiple Choice

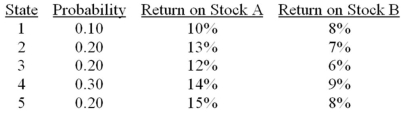

Consider the following probability distribution for stocks A and B:  If you invest 40% of your money in A and 60% in B, what would be your portfolio's expected rate of return and standard deviation

If you invest 40% of your money in A and 60% in B, what would be your portfolio's expected rate of return and standard deviation

A) 9.9%; 3%

B) 9.9%; 1.1%

C) 11%; 1.1%

D) 11%; 3%

E) None of the options

Correct Answer:

Verified

Correct Answer:

Verified

Q15: A statistic that measures how the returns

Q23: Which of the following statement(s) is(are) false

Q41: Efficient portfolios of N risky securities are

Q44: Consider the following probability distribution for stocks

Q49: Market risk is also referred to as<br>A)systematic

Q55: Portfolio theory as described by Markowitz is

Q59: In a two-security minimum variance portfolio where

Q61: Which of the following statement(s) is(are) false

Q68: When borrowing and lending at a risk-free

Q80: The measure of risk in a Markowitz