Multiple Choice

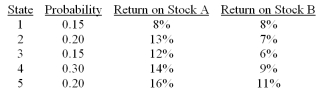

Consider the following probability distribution for stocks A and B:  The expected rates of return of stocks A and B are _____ and _____, respectively.

The expected rates of return of stocks A and B are _____ and _____, respectively.

A) 13.2%; 9%

B) 13%; 8.4%

C) 13.2%; 7.7%

D) 7.7%; 13.2%

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Consider two perfectly negatively correlated risky securities

Q22: The risk that can be diversified away

Q29: The variance of a portfolio of risky

Q32: State Markowitz's mean-variance criterion.Give some numerical examples

Q33: The individual investor's optimal portfolio is designated

Q35: The efficient frontier of risky assets is<br>A)the

Q37: Which statement about portfolio diversification is correct<br>A)Proper

Q43: Security X has expected return of 12%

Q44: Consider two perfectly negatively correlated risky securities,

Q72: When two risky securities that are positively