Multiple Choice

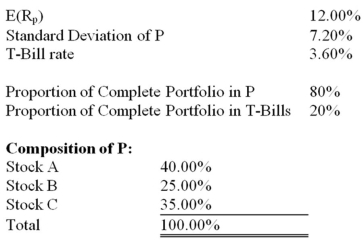

Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills.The information below refers to these assets.  What is the expected return on Bo's complete portfolio

What is the expected return on Bo's complete portfolio

A) 10.32%

B) 5.28%

C) 9.62%

D) 8.44%

E) 7.58%

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Treasury bills are commonly viewed as risk-free

Q14: In the mean-standard deviation graph an indifference

Q15: Draw graphs that represent indifference curves for

Q18: Consider a T-bill with a rate of

Q19: The certainty equivalent rate of a portfolio

Q20: In the utility function: U = E(r)

Q27: You invest $100 in a risky asset

Q46: You invest $100 in a risky asset

Q64: According to the mean-variance criterion, which one

Q65: Which of the following statements regarding risk-averse