Multiple Choice

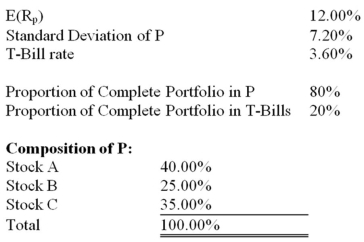

Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills.The information below refers to these assets.  What is the equation of Bo's capital allocation line

What is the equation of Bo's capital allocation line

A) E(rC) = 7.2 + 3.6 × Standard Deviation of C

B) E(rC) = 3.6 + 1.167 × Standard Deviation of C

C) E(rC) = 3.6 + 12.0 × Standard Deviation of C

D) E(rC) = 0.2 + 1.167 × Standard Deviation of C

E) E(rC) = 3.6 + 0.857 × Standard Deviation of C

Correct Answer:

Verified

Correct Answer:

Verified

Q25: You are considering investing $1,000 in a

Q28: Asset allocation may involve<br>A) the decision as

Q33: Assume an investor with the following utility

Q35: Given the capital allocation line, an investor's

Q35: Steve is more risk-averse than Edie. On

Q36: An investor invests 70% of his wealth

Q41: Which of the following statements regarding the

Q41: An investor invests 40% of his wealth

Q42: The riskiness of individual assets<br>A) should be

Q48: You invest $100 in a risky asset