Multiple Choice

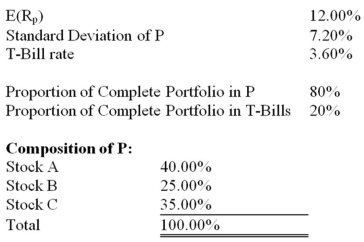

Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills.The information below refers to these assets.  What are the proportions of stocks A, B, and C, respectively, in Bo's complete portfolio

What are the proportions of stocks A, B, and C, respectively, in Bo's complete portfolio

A) 40%, 25%, 35%

B) 8%, 5%, 7%

C) 32%, 20%, 28%

D) 16%, 10%, 14%

E) 20%, 12.5%, 17.5%

Correct Answer:

Verified

Correct Answer:

Verified

Q2: You are considering investing $1,000 in a

Q5: You invest $100 in a risky asset

Q7: A reward-to-volatility ratio is useful in<br>A)measuring the

Q9: What is a fair game<br> Explain how

Q11: The change from a straight to a

Q14: Which of the following statements is(are) true?I)

Q26: You invest $100 in a risky asset

Q47: To build an indifference curve, we can

Q50: You invest $1,000 in a risky asset

Q66: An investor invests 35% of his wealth