Multiple Choice

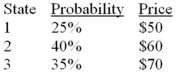

Toyota stock has the following probability distribution of expected prices one year from now:  If you buy Toyota today for $55 and it will pay a dividend during the year of $4 per share, what is your expected holding-period return on Toyota

If you buy Toyota today for $55 and it will pay a dividend during the year of $4 per share, what is your expected holding-period return on Toyota

A) 17.72%

B) 18.89%

C) 17.91%

D) 18.18%

Correct Answer:

Verified

Correct Answer:

Verified

Q7: You have been given this probability distribution

Q9: Skewness is a measure of<br>A)how fat the

Q14: If a portfolio had a return of

Q14: Historical records regarding return on stocks, Treasury

Q15: You have been given this probability distribution

Q16: You have been given this probability distribution

Q17: If the annual real rate of interest

Q24: If an investment provides a 2.1% return

Q27: If a portfolio had a return of

Q51: Which of the following determine(s) the level