Essay

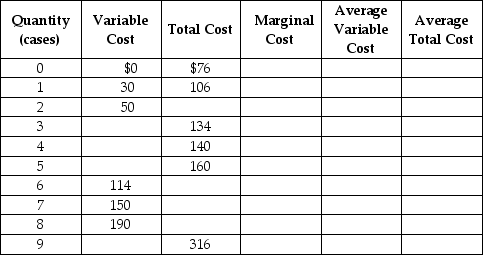

Table 8.5  Use the table to answer the following questions.

Use the table to answer the following questions.

a.Complete Table 8.5 by filling in the blank cells.

b.Werner is selling in a perfectly competitive market at a price of $40.What is the profit maximising or loss-minimising output?

c.Calculate the firm's profit or loss.

d.Should the firm continue to produce in the short run? Explain.

e.If the firm's fixed costs were $30 higher, what would be the profit-maximising output level in the short run? Indicate whether the output level will increase, decrease or remain unchanged compared to your answer in b.

f.Suppose fixed cost remains at $76.If the price of three-ring binders falls to $20 what is the profit-maximising or loss-minimising output?

g.Calculate the profit or loss.Should the firm continue to produce in the short run? Explain your answer.

h. Suppose the fixed cost remains at $76.What price corresponds to the shut-down point?

i.Suppose the fixed cost remains at $76.What price corresponds to the break-even point?

__________________________________________________________________________________________________________________________________________________________________________________________

-Werner & Sons is a manufacturer of three-ring binders operating in a perfectly competitive industry.Table 8.5 shows the firm's cost schedule.

Correct Answer:

Verified

a.  b.Quantity = 8 units.

b.Quantity = 8 units.

c.Profit = $54...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

c.Profit = $54...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: A perfectly competitive firm produces 3000 units

Q7: Which of the following is not a

Q11: What does an industry's long-run supply curve

Q13: Figure 8.5 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 8.5

Q21: An individual seller in perfect competition will

Q108: What is meant by allocative efficiency? How

Q177: If a typical firm in a perfectly

Q233: Suppose the equilibrium price in a perfectly

Q244: When a perfectly competitive firm finds that

Q265: In an increasing-cost industry the long-run supply