Essay

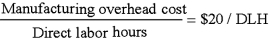

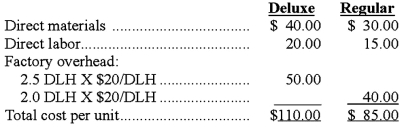

Swenson Company manufactures 4,000 units of Deluxe Product and 20,000 units of Regular Product each year. The company currently uses direct labor-hours to assign overhead cost to products. The pre-determined overhead rate is:

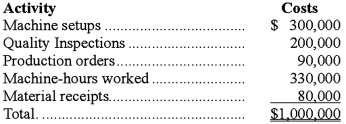

Suppose, however, that factory overhead costs are actually caused by the five activities listed below:

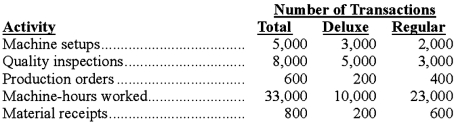

Suppose, however, that factory overhead costs are actually caused by the five activities listed below:  Also suppose the following transaction data has been collected:

Also suppose the following transaction data has been collected:  Required:

Required:

Using the activity-based costing method to calculate unit costs of Deluxe and Regular products, and compare them with the current direct labor hours-based costing system.

Correct Answer:

Verified

Answer may vary

Feedback: Overhead rates...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Feedback: Overhead rates...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Diamond Cleats Co. manufactures cleats for baseball

Q27: A measure of frequency and intensity of

Q39: Castenet Company uses a volume-based costing system

Q42: Everlast Co. manufactures a variety of drill

Q55: Volume-based overhead rates may cause undesirable strategic

Q58: Which of the following is a benefit

Q61: Successful activity-based costing (ABC) implementation depends upon

Q86: Sheen Co. manufacturers laser printers. It has

Q94: National Inc. manufactures two models of CMD

Q136: Activity-based costing (ABC) differs from other costing