Multiple Choice

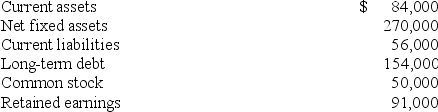

A firm has the following account balances for this year.Sales for the year are $420,000.Projected sales for next year are $441,000.The percentage of sales approach is used for pro forma purposes.All balance sheet accounts,except long-term debt and common stock,change according to that approach.The firm plans to decrease the long-term debt balance by $23,500 next year.Retained earnings is expected to increase by $5,400 next year.What is the projected external financing need?

A) -$14,150

B) -$6,850

C) $32,850

D) $36,000

E) $56,350

Correct Answer:

Verified

Correct Answer:

Verified

Q24: O'Hara's Market has net income of $1.6

Q26: Which one of the following will increase

Q27: What is the investment cash flow,given the

Q28: A firm has $3,200 of cash,equipment worth

Q30: Wholesale Grocer's has total assets of $580,000

Q31: The Corner Market had annual sales of

Q33: Handy Man Services,Inc.has net income of $525,000.What

Q34: AccentJewelry,Inc.has annual sales of $4.8 million and

Q36: A decrease in which one of the

Q58: Which one of the following is equal