Multiple Choice

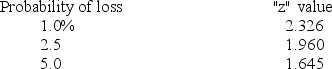

Lester has a portfolio with an average return of 13.5 percent and a standard deviation of 14.5 percent.He has a one percent probability of losing ________ percent or more in any given year.

A) −33.97

B) −38.87

C) −20.23

D) −5.04

E) −8.37

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Which one of the following measures a

Q25: Which one of the following statements is

Q31: The Jensen-Treynor alpha is equal to:<br>A)the Treynor

Q35: You are comparing three securities and discover

Q40: Which one of the following is computed

Q62: What is the Treynor ratio of a

Q63: A portfolio has a beta of 1.30

Q69: Which one of the following is the

Q72: Angie owns a portfolio which has an

Q86: The Value-at-Risk measure assumes which one of