Multiple Choice

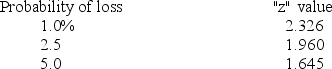

Lester has a portfolio with an average return of 13.5 percent and a standard deviation of 22.5 percent.He has a one percent probability of losing ________ percent or more in any given year.

A) −33.97

B) −38.94

C) −20.23

D) −5.04

E) −8.37

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: Which one of the following measures risk

Q39: The Sharpe-optimal portfolio will be the investment

Q44: You want to create the best portfolio

Q48: The U.S.Treasury bill has a return of

Q49: Your portfolio has a standard deviation of

Q50: A portfolio has a beta of 1.26,a

Q51: A fund has an alpha of 0.73

Q61: Which one of the following is a

Q64: Which one of the following statements is

Q83: Which of the following measures are dependent