Multiple Choice

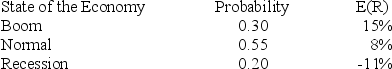

The risk-free rate is 3.5 percent.What is the expected risk premium on this security given the following information?

A) 2.09 percent

B) 3.01 percent

C) 3.20 percent

D) 3.87 percent

E) 4.15 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q51: To reduce risk as much as possible,

Q63: A portfolio that belongs to the Markowitz

Q72: You have a portfolio which is comprised

Q73: A portfolio comprised of which one of

Q76: What is the standard deviation of the

Q79: You have a portfolio which is comprised

Q80: What is the standard deviation of the

Q81: The risk-free rate is 4.15 percent.What is

Q82: Stock X has a standard deviation of

Q93: Which one of the following statements is