Multiple Choice

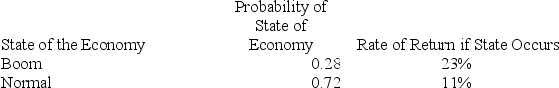

The risk-free rate is 4.20 percent.What is the expected risk premium on this stock given the following information?

A) 5.85 percent

B) 6.59 percent

C) 8.22 percent

D) 10.16 percent

E) 11.21 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: If two assets have a zero correlation,

Q27: Which one of the following statements is

Q35: Which one of the following correlation relationships

Q39: Which of the following will increase the

Q45: You currently have a portfolio comprised of

Q46: The division of a portfolio's dollars among

Q48: You have a portfolio which is comprised

Q50: Rosita owns a stock with an overall

Q54: You have a portfolio which is comprised

Q75: Which one of the following is eliminated,