Multiple Choice

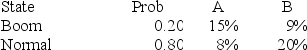

You have a portfolio which is comprised of 60 percent of stock A and 40 percent of stock B.What is the expected rate of return on this portfolio?

A) 12.76 percent

B) 12.88 percent

C) 13.44 percent

D) 13.56 percent

E) 13.85 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: If two assets have a zero correlation,

Q6: Where does the minimum variance portfolio lie

Q27: Which one of the following statements is

Q39: What is the expected return on this

Q41: You have a portfolio which is comprised

Q43: A portfolio consists of the following securities.What

Q45: You currently have a portfolio comprised of

Q46: The division of a portfolio's dollars among

Q89: Which of the following are affected by

Q92: What is the correlation coefficient of two