Multiple Choice

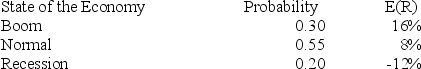

The risk-free rate is 3.0 percent.What is the expected risk premium on this security given the following information?

A) 2.90 percent

B) 3.01 percent

C) 3.20 percent

D) 3.80 percent

E) 4.15 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q24: Stock A has a standard deviation of

Q25: Tall Stand Timber stock has an expected

Q26: A stock fund has a standard deviation

Q27: A stock fund has a standard deviation

Q28: Non-diversifiable risk:<br>A) can be cut almost in

Q30: An efficient portfolio is a portfolio that

Q31: Which one of the following correlation coefficients

Q32: Which one of the following returns is

Q33: You have a portfolio which is comprised

Q34: Alicia has a portfolio consisting of two