Multiple Choice

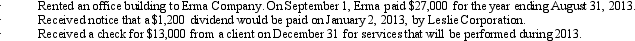

Nona Corporation, a calendar-year company, had the following transactions during 2012:  Assuming cash-basis accounting for Nona Corporation, how much income should be reported on its 2012 income statement?

Assuming cash-basis accounting for Nona Corporation, how much income should be reported on its 2012 income statement?

A) $21,000

B) $27,000

C) $40,000

D) $41,200

Correct Answer:

Verified

Correct Answer:

Verified

Q102: Mancheski and Sons Inc. reported net income

Q103: In the course of your examination of

Q104: When preparing its financial statements, a company

Q105: The purpose of financial statement analysis is

Q106: An expired asset is called a(n)<br>A) Revenue<br>B)

Q107: Scully Corporation purchased a three-year insurance policy

Q108: Which of the following statements about adjusting

Q109: The entry to close the expense accounts

Q110: On April 1, Ciaunna Company paid $48,000

Q112: The following are a selection of account