Essay

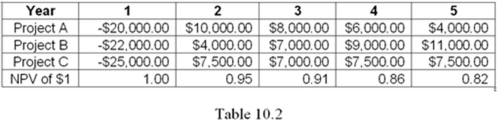

The Table 10.2 below shows net cash flows for 3 mutually exclusive projects from which a company can choose.Each project requires an investment in the first year,then produces a positive net cash flow for each of the following four years.Assuming an interest rate of 5%,which project would the company choose? Does the best project have the highest total net cash flow? The shortest payback period?

Correct Answer:

Verified

The NPV of each project is calculated in...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: What would the interest rate need to

Q41: Which of the following is a way

Q42: What happens to saving when interest rates

Q43: Assume the interest rate is 5%.What is

Q44: What happens to borrowing when interest rates

Q46: Using a carefully-labeled graph,explain the Life Cycle

Q47: Table 10.1 shows the cash flows and

Q48: Jennifer has just finished high school and

Q49: When the interest rate rises,saving becomes _

Q50: Joe has just retired and would like