Essay

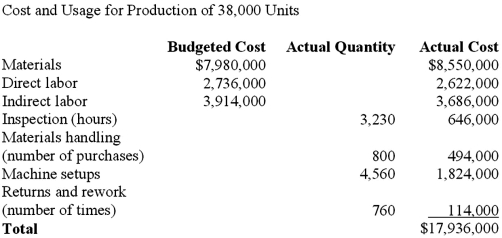

DualShaft Inc. manufactures a wide variety of parts for recreational boating, including boat engines. The component is purchased by OEM (original equipment manufacturers) such as Mercury and Honda, for use in the larger and more powerful outboards. The units sell for $790, and sales volume averages 38,000 units per year. Recently, DualShaft's major competitor lowered the price of the equivalent part to $710. The market was very competitive, and DualShaft realized it had to meet the new price or lose significant market share. The controller assembled the following data for the most recent year. Required:

Required:

1.Calculate the target cost for maintaining current market share and profitability.

2.How should the company attempt to reduce cost to meet the new target cost?

Correct Answer:

Verified

1.  Target cost is $392, an $80 reductio...

Target cost is $392, an $80 reductio...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: A type of strategic pricing based on

Q33: Henry Ford was an early pioneer in

Q34: Johnson Marine has the following costs

Q35: The five tasks that follow take place

Q36: The goals of coordinating manufacturing processes, reducing

Q38: The Gargus Company, which manufactures projection

Q39: Electronic Component Company (ECC) is a producer

Q40: Which of the following is a theory

Q41: Ken Yalters, the COO of FreshSkin,

Q42: Ken Yalters, the COO of FreshSkin,